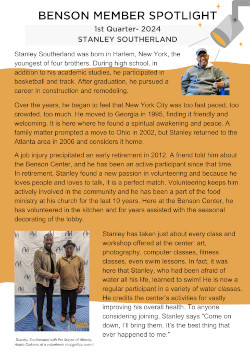

Stanley Southerland was born in Harlem, New York, the youngest of four brothers. During high school, in addition to his academic studies, he participated in basketball and track. After graduation, he pursued a career in construction and remodeling.

Over the years, he began to feel that New York City was too fast paced, too crowded, too much. He moved to Georgia in 1995, finding it friendly and welcoming. It is here where he found a spiritual awakening and peace. A family matter prompted a move to Ohio in 2002, but Stanley returned to the Atlanta area in 2006 and considers it home.

A job injury precipitated an early retirement in 2012. A friend told him about the Benson Center, and he has been an active participant since that time. In retirement, Stanley found a new passion in volunteering and because he loves people and loves to talk, it is a perfect match. Volunteering keeps him actively involved in the community and he has been a part of the food ministry at his church for the last 10 years. Here at the Benson Center, he has volunteered in the kitchen and for years assisted with the seasonal decorating of the lobby.

Andre Dickens at a volunteers recognition event.

Stanley has taken just about every class and workshop offered at the center: art, photography, computer classes, fitness classes, even swim lessons. In fact, it was here that Stanley, who had been afraid of water all his life, learned to swim! He is now a regular participant in a variety of water classes. He credits the center’s activities for vastly improving his overall health. To anyone considering joining, Stanley says “Come on down, I’ll bring them. It’s the best thing that ever happened to me.”

View and/or download a pdf file of this post here: